Understanding your customer acquisition cost (CAC) is at the heart of growing your business in a scalable and profitable way.

Every business faces opportunity costs. We cannot pursue every campaign, every channel, or every market segment to acquire new customers. Marketers must decide where best to allocate their budgets and their marketing efforts.

READ: 5 Ways to increase conversions with your content

These decisions are made even more critical by the fact that the cost of acquiring new customers has increased by more than 50% over the past five years.

The maturity of paid advertising channels like Google Adwords and the increase in quality and quantity of content being published on blogs across the web means that organic channels are quickly following suit. The result is that businesses have to work harder and, most importantly, smarter to grow.

Remember, growth is great but growth at any cost is deadly. Just ask WeWork.

And that’s where your customer acquisition costs come in.

What is Customer Acquisition Cost (CAC)?

Customer Acquisition Cost (CAC) is the total cost of marketing and sales to acquire a customer. It is one of the defining factors in whether your company has a viable business model that can yield profits by keeping acquisition costs low as you scale.

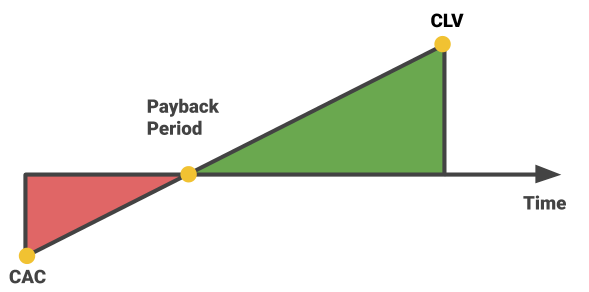

The challenge is balancing the total sales and marketing costs required to get new customers (CAC) with the revenue generated by each customer over their lifetime or customer lifetime value (LTV).

Play it safe, and you risk losing out on potential customers and all the future revenue they would generate. Overspend and you will end up paying them to be your customers which will ultimately lead to failure.

READ: How to convert free trial and freemium users into paying customers

How to calculate CAC?

CAC is calculated by dividing the total cost of marketing and sales by the number of customers acquired over a specific period. For example, if a company spent R100 on marketing and sales in a year and acquired 100 customers in the same year, their CAC is R1.00.

Why is your CAC so important?

Like any metric CAC is a lever that businesses can adjust to help them meet their goals and, depending on their strategy, be a source of competitive advantage.

Let’s dive in and take a look at the 3 main reasons why measuring CAC is important for your business.

1. Simplify decision making

In its simplest form, CAC tells us how much it costs us to attract new customers but if we take a closer look, we see that it also provides a mechanism by which to simplify our decision-making process.

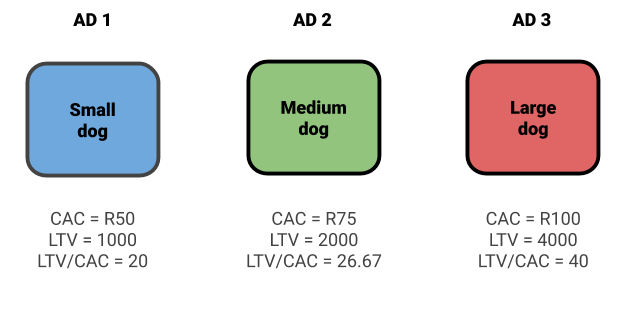

Imagine you run a pet shop and are preparing for the final quarter of the year and for the past 3 months you have been testing three different ads. So far, each ad has received 100 clicks and produced 10 new customers.

From a high level, they seem to have performed the same. If you stopped there, you might continue running all three ads in the next quarter.

READ: Here’s why you need a content distribution strategy

But when we start allocating the cost of achieving 100 clicks for each ad, we start to see the difference.

The cost per click (CPC) for Ad 1 is R5, Ad 2 is R7,50, and Ad 3 is R10. We can now calculate our customer acquisition costs (CAC), and it becomes pretty clear that Ad 1 significantly outperformed the other two.

Although this is a simple example, it’s clear to see why CAC is an effective decision-making metric.

2. It helps optimise marketing and sales activities to focus on customer lifetime value (LTV)

It is easy to get distracted and focus solely on trying to achieve the lowest CAC possible, but it is important to remember that costs are not all bad. Let’s take a look at our example again.

It was clear that Ad 1 had the lowest CAC but let’s assume that each ad was for the same product, your house brand of dog food, but targeted different customer segments, small dogs, medium dogs, and large dogs.

Let’s assume that small dogs eat the least amount of food and on average their owners make 10 purchases, medium dogs eat twice as much as small dogs so their owner makes a total of 20 purchases, and large dogs eat twice as much as medium dogs so their owners make 40 purchases over the 2 years they are your customers.

This significantly changes the value of each ad. If we calculate the LTV, on an average purchase price of R100 we see that for Ad 1 it’s R1000, for Ad 2 it’s R2000, and for Ad 3 it’s R4000.

If we take a look at your LTV/CAC ratio for the quarter we see that for every rand you spent on Ad 1 you got R20 back. For Ad 2 the ratio improves putting R26,67 back in your pocket while the clear winner was Ad 3, targeting large dogs, which generated R40 for every rand spent.

From this perspective, although Ad 3 had the highest CAC, the returns it generated far exceeded the cost making it the clear winner.

READ: Top 5 marketing challenges in Africa & how to solve them

Add more complexity to the equation by adding more products or services, targeting new customer segments, testing out different channels and you will start to see why using CAC in conjunction with the customer lifetime value (LTV) is so important.

Without it, it would be very difficult for businesses and their marketing teams to prioritise their resources effectively.

3. Determining and optimising your payback period

Most analysis of customer acquisition cost ends with the LTV/CAC ratio, which doesn’t paint the complete picture.

The third element needs to be considered: the payback period.

A payback period is the rate at which you can get cash from your paying customers. This dictates how quickly you can reinvest in your business and ideally is a component of how you calculate CAC.

READ: 5 Ways to reduce customer churn and drive sales

Payback periods matter because in a well-run business cash flow matters. It’s better to have money today that lets you scale and grow more quickly than it is to have money 5 years from now.

Key Takeaways

Every business wants to grow, but figuring out how to scale your marketing activities while driving long-term value can be difficult.

Customer acquisition cost (CAC) provides a starting point by simplifying complex customer acquisition strategies into numbers that can be compared with each other.

Adding customer lifetime value (LTV) to the calculation enhances the metric, allowing us to move past the concept of cost to metrics that provide insight into longer-term value.

From this perspective, it becomes clear that understanding your CAC is important for all businesses, whether you are growing despite the cost or whether you are trying to optimise your efforts.