Your customers are central to the success of your business.

But, they’re even more central to your business than the money they spend today.

If you are successfully able to retain your customers, they will provide your business with future revenue too.

We, therefore encourage the understanding of the lifetime value of your customers.

The customer lifetime value (LTV) can be defined as this:

It is a prediction of the revenue a business will receive from a customer throughout their entire future relationship it has with this customer.

In understanding this, you’re able to identify which customers are the most profitable ones for your business.

But…it will also show you which customer relationships need nurturing in order to retain them and maintain a healthy NPS.

Take a look at this:

- According to Harvard Business Review, it’s 5-25 times more expensive to acquire a new customer than it is to retain an existing one.

- According to Bain and Company, a 5% increase in customer retention can increase a company’s profitability by 75%.

- According to a report by eConsultancy, 82% of companies believe that retention is cheaper than acquisition activities.

Knowing your LTV metric will provide you insights into your business’s future profitability.

We’re talking future financial predictions. I’m sure most businesses today, could do with a little more data-driven insights.

So without further delay, let's get stuck in.

In this blog post, I’m going to show you exactly how to calculate your customer lifetime value and highlight some high-level business benefits you could experience through knowing your LTV.

Here’s your TL: DR Summary:

- Customer retention should be a core business activity.

- LTV can be calculated - we’ll take you through it step-by-step.

- The core benefits of understanding your LTV

- You’re able to scale your business profitably.

- Understand the financial impact of your marketing activities.

- You’re able to boost customer retention

- You can use your knowledge to encourage brand loyalty

How to calculate the customer lifetime value for your business:

Luckily enough for me, I don’t need to be an excellent mathematician to show you how to calculate your customer lifetime value (LTV).

To get started we need a few things worked out before calculating your LTV metric:

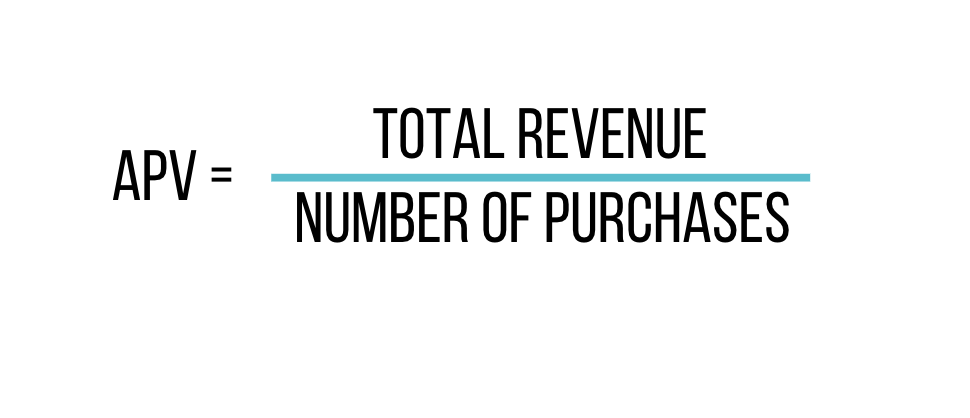

What is your business’s average purchase value (APV)? This calculation requires you to divide your company’s total revenue over a certain time period by the number of purchases in that very same period.

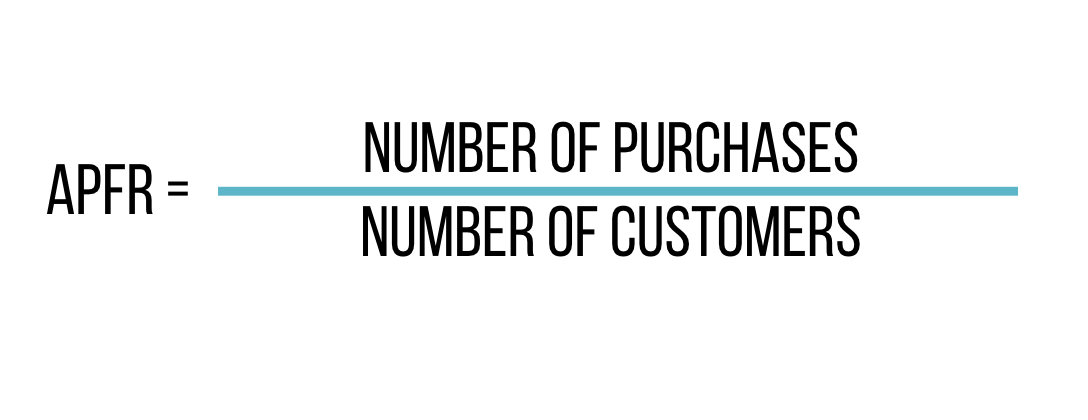

What is your business’s average purchase frequency rate (APFR)? Calculate this by dividing the number of purchases by the number of unique customers who made purchases during your specific time frame (as decided above).

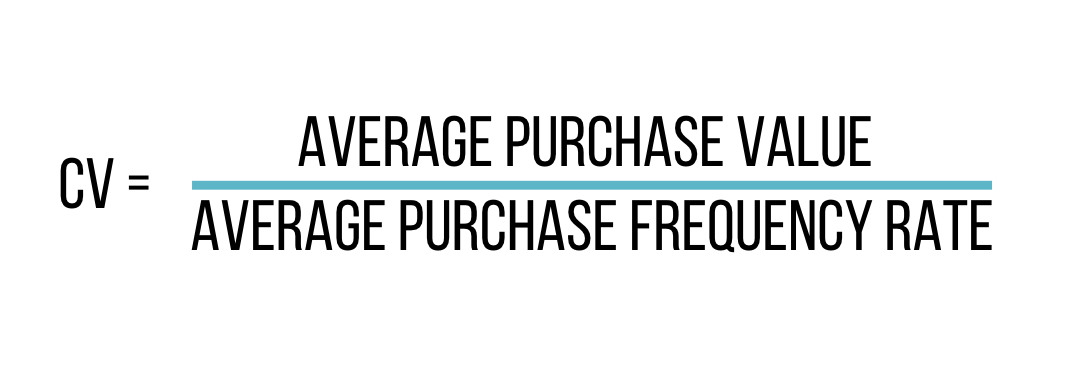

What is your customer value (CV)? You calculate this by multiplying the average purchase value by the average purchase frequency rate.

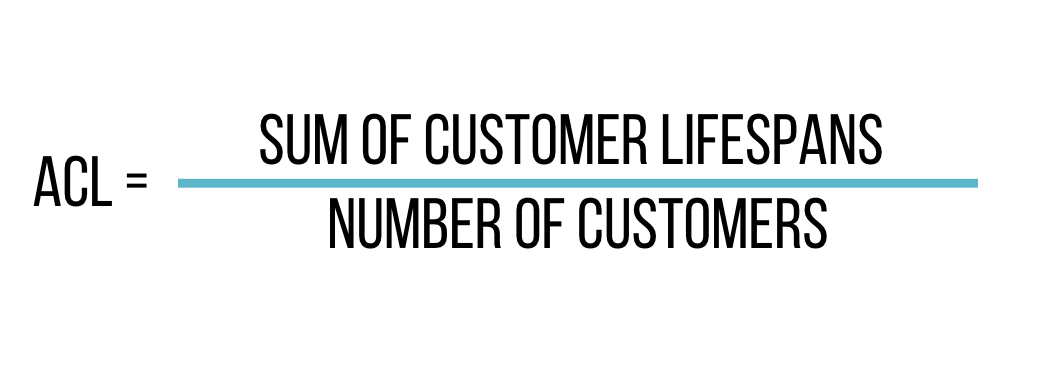

What is the average customer lifespan (ACL)? You need to calculate this by averaging the number of years a customer continues to purchase from your company.

Drum roll, please…

It’s now time to calculate your LTV:

You need to multiply the customer value by the average customer lifespan.

The number you generate here will give you the estimated revenue you can roughly expect from a customer to spend with you over their time with your business.

What are the benefits of understanding your Customer Lifetime Value:

You’re able to scale your business profitably.

An accurate understanding of your LTV has the ability to show you how much you can spend on acquiring new customers, developing new campaigns and delighting and retaining your existing customers.

The LTV metric allows you to grow your business with the future in mind, there’s no other metric like it.

Understand the financial impact of your marketing activities.

Customer lifetime value really is an important metric. It has the ability to highlight the financial impacts your marketing activities have had.

Your LTV, in conjunction with your customer acquisition cost (CAC), will help identify which channels and activities have been the most profitable for your business. This data should then go on to help you develop strategies that should have the highest return on investment for your business.

It boosts customer retention.

According to research conducted by Motista, who analysed over 100 000 consumers over a two year period found that consumers with an emotional connection to a brand have a 306% higher lifetime value.

The result of this proves that the experience your customers have with you is crucial to their happiness and the longevity of their relationship with you.

But it also provides you with insights that can help you develop customer loyalty initiatives such as a referral program.

It encourages brand loyalty.

In all your efforts you should be aiming for a high customer lifetime value. This value identifies customers that have proven their loyalty to your brand. Loyal, happy customers are often the ones to share your brand with others.

In fact, according to the Journal of Marketing, referred customers are 18% more loyal, spend 13.2% more and have 16% higher lifetime values than non-referred customers.

Key Takeaways

Your customers are core to your business, we know this.

But, understanding the customer lifetime value provides your business with future insights into your profitability and potential for growth.

These insights should be used to develop customer-focused strategies that promote feedback and growth, that then directly impact any future marketing campaigns you choose to run.

If you’re looking for the complete guide to customer acquisition then click the button below to get your hands on a copy of our most recent eBook.